Statistical probability (in percentages) of people of various age and gender to suffer a critical illness before they reach age 75.

There is not distinction according to lifestyle (e.g. smoking status, physical activity) or health attributes (genetic makup or obesity, e.g.) here; the numbers refer to averages. For couples, the percentage refers to the chance that at least one of them will suffer a critical illness. The assumption used here is that the couple is a male and female, of the same age. Though the data refer to 22 specific conditions covered by a particular critical illness policy, they are most likely reasonably relevant in a more general sense as well.

The last two columns are relevant in business situations: the assumption here is that there is a team of one female and two or three males of the same age, and the calculation is done so that the probabilities refer to suffering a critical illness by at least one of them before they are 65.

|

We can calculate the long term impact of a potential critical illness on the retirement of somebody. Since we do not foresee the future, we have to make assumptions, and it makes sense to try various scenarios. Here I show just one example, to demonstarte the factors to be considered, and to show the outcome of one arbitrary, but reasonable scenario.

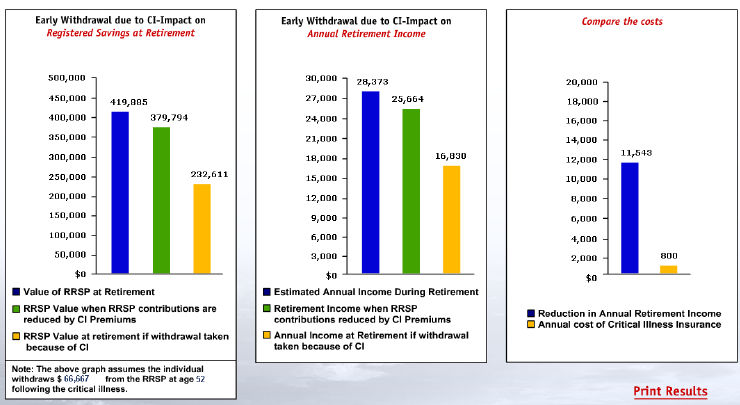

We assume a 40 year old male here, who wants to retire at age 65. He wants to plan up to age 90, because planning only to his life expectancy would still mean he has a 50% chance of outliving his plan. Letís assume he has a $50,000 RRSP now, and that he plans to contribute $5,000 to that annually. Furthermore, we assume a 3% annual rate of inflation, and 8% growth rate in his RRSP investments. The assumption is that these rates are even; obviously in real life they arenít but it makes the calculation simpler.

Next, we assume that he suffers a critical illness at age 52, which will cost him $40,000 to recover from. (This cost may include extra medical care, lost income, travel, home adjustment, etc.) We assume that he is in a 40% marginal tax bracket. Letís assume that the illness causes a lapse in his RRSP contributions at age 52, but that he will be able to contribute the same annual $5,000 from age 55. He may want to retire two years earlier, that is at age 63 after having suffered the critical illness, and his life expectancy may be shortened to age 85 because of the critical illness occurrence.

We want basically prepare a cost/benefit analysis of buying a critical illness policy of only $40,000 . We assume he pays $800 for this protection annually.

With all these assumptions underlined in the above three paragraphs, the outcome can be summed up in this chart:

As you can see, his retirement income from this RRSP suffers significantly in this scenario ($11,543 annually) if there is no insurance policy, but it suffers much less if there is one. Itís important to realize that one can pick other reasonable scenarios that will show a better or worse outcome. Any change in the underlined assumptions above would influence the outcome, ... but in most situations the moral of the story would be the same: considering the probabilities shown in the table on the top of this page, itís prudent to spend money on a critical insurance policy because if you will not need it, you suffer a much smaller loss then you would if you do suffer a critical illness without having this protection.

Please click here if you want to see the pdf version (1.9. Mb !!) of the whole calculation.

Top page (on personal financial planning)

Key areas:

Life and health insurance (including disability, critical illness, and long-term care protection)

If you are / have ...

|

These web pages are for information purposes only. The information contained and presented, while based on and obtained from sources we believe to be reliable, is not guaranteed either as to its accuracy or completeness. The content of these web pages is solely the work of the author, Laszlo Kramar. The views (including any recommendations) expressed on these pages are those of the author alone, and they have not been approved by anybody. Neither the information nor any opinion expressed herein constitutes an offer, or an invitation to make an offer, to buy or sell any product discussed or referred to in these web sites. These web pages are for educational purposes only and are not intended for use by residents of the United Sates; nor are they intended as an offer or solicitation in any jurisdiction outside of Ontario, Canada. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. |

(c) Copyright 1997-2006 LŠszlů KramŠr. All Rights Reserved.